Our products

Wealth is more than money. Managed the right way, it can be a tool that gets you closer to your goals. That is where we can help. Putting our clients first has made us help our clients to achieve the returns they desire.

Money Market Funds

As global central banks continue to raise rates this year, investors are faced with new consideratio...

Read more

Structured Notes

While structured products may be new to you, they have been used for decades by institutional and in...

Read more

ETFs

You can benefit from our status as one of the most experienced global ETF distributors...

Read more

Real Estate

Helping real estate organizations and HNW maximize the value of their investments and transform thei...

Read more

Scroll to check each products

How we work with you

Your main point of contact is your client relationship advisor. Through your dedicated advisor, you and your family have access to our wide range of investment products and solutions through our extensive network.

Your advisor is supported by our global capabilities and resources. This includes our Chief Investment Office (CIO) and a number of investment and product experts, namely lending and mortgage specialists, foreign exchange, fund and investment specialists as well as wealth and financial planners.

With these tools and resources at the ready, we’re able to deliver the best for your personal portfolio.

Money Market Funds

Your main point of contact is your client relationship advisor. Through your dedicated advisor, you and your family have access to our wide range of investment products and solutions through our extensive network.

We believe investors may want to consider money market funds (MMFs) as an alternative to bank deposits in today’s rising rate environment. Although bank deposits have sometimes offered incremental yield over MMFs in the lead up to past rate hiking cycles, it historically hasn’t taken long for MMFs to surpass them.

Structured Notes

While structured products may be new to you, they have been used for decades by institutional and individual investors. A structured product combines many of the characteristics of a bond with certain of the features and risks of the structured product’s underlying asset. Like a bond, a structured product is issued by a corporation, usually an investment grade financial company, and is subject to the credit risk of the issuer. But unlike a bond, a structured product is linked to an underlying asset and may offer some or all of the upside growth as well as the downside market risk of the underlying asset.

Newsletter

Sign up to keep up with the latest going in our world.

Regardless of its features, all payments on a structured product are made by its issuer, and if the issuer is unable to pay its obligations when due, investors may lose some or all of their investment.

DKK classifies structured products into four categories to

make it easier to identify the investment that may suit your needs:

Underlying asset the index, security, commodity or other investment

or benchmark to which a structured product is linked.

ETFs

You can benefit from our status as one of the most experienced global ETF distributors. We offer high quality index replication strategies, supported by a seasoned and skilled portfolio management team through our partners.

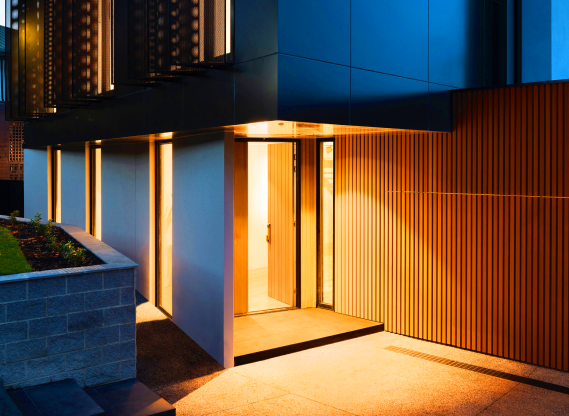

Real Estate

Helping real estate organizations and HNW maximize the value of their investments and transform their businesses. We pair extensive real estate and functional expertise with deep tenant knowledge across sectors to help organizations and individual reimagine the role they play in space acquisition, development, and use.